Trusted Tax, Accounting & Small Business Support in Oak Creek, WI

Tax preparation, bookkeeping, payroll, and business advisory services for individuals and small businesses across Oak Creek, Milwaukee, Franklin, Greenfield, and Greendale.

American Elite Tax

We work closely with entrepreneurs, LLCs, and growing businesses to ensure accurate reporting and regulatory compliance.By focusing on transparency and personalized service, American Elite Tax helps clients reduce stress, avoid penalties, and stay financially organized as their businesses and personal needs evolve.

Services

Your Trusted Partner for Tax, Accounting, and Financial Success

Individual Tax Preparation

Professional tax preparation for individuals and families, ensuring accurate filing and maximum deductions. Serving Oak Creek, Milwaukee, Franklin, and surrounding areas.

Business Tax Preparation

Business tax preparation for LLCs, S-Corps, and C-Corps, with accurate filings and strategic guidance to support long-term success.

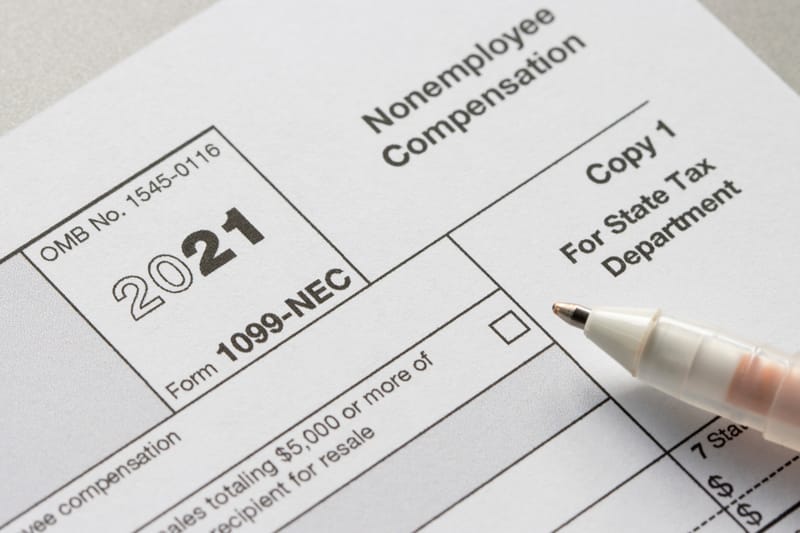

Self-Employed & 1099 Tax Services

Tax preparation and planning for self-employed individuals, freelancers, and independent contractors, including 1099 income.

Sales Tax Filing & Compliance

Sales tax registration, filing, and compliance support for Wisconsin businesses, including monthly, quarterly, and annual filings.

IRS Representation

Professional IRS representation for audits, notices, and disputes, providing clear guidance and strategic resolution support.

Back Taxes

Back tax filing and IRS resolution services for individuals and businesses with late returns, unpaid taxes, or IRS notices.

Tax Planning Services

Personalized tax planning strategies to help individuals and businesses minimize tax liabilities and plan for the future.

Amended Tax Returns

Preparation and filing of amended tax returns (Form 1040-X) to correct prior-year tax filings and claim missed deductions.

Accounting & Bookkeeping

Professional accounting and bookkeeping services to keep your business organized, compliant, and financially informed. Accurate records, monthly reporting, and year-round support for small businesses.

Payroll Services

Reliable payroll services including employee payments, tax withholdings, and required filings. Reduce administrative burden and ensure accurate, on-time payroll processing.

Financial Statements & Reports

Preparation of profit & loss statements, balance sheets, and financial reports for business owners, lenders, and compliance needs.

Monthly Bookkeeping

Monthly bookkeeping services including bank reconciliations, expense tracking, and financial reports to keep your business on track.

New Business Setup & Entity Formation

Assistance with LLC, S-Corp, and C-Corp formation, EIN registration, licensing guidance, and compliance setup for new businesses.

USDOT & Motor Carrier Setup

Assistance with USDOT registration, MCS-150 setup, operating authority guidance, UCR registration, and coordination with authorized third-party agents.

Merchant Services & Credit Card Processing

Nasco Financial Services, featured by American Elite Tax, Secure credit card processing, POS systems, terminals, fast deposits, and transparent pricing for small and medium-sized businesses.

ATM Placement & Processing Services

Nasco Financial Services, featured by American Elite Tax, provide ATM placement and processing with no upfront cost, fast settlement, and revenue-sharing options to increase in-store cash flow.

Business Legal Forms & Contracts

Drafting of business agreements including leases, bills of sale, partnership agreements, and promissory notes. Not legal advice.

Check Printing & Business Check Supplies

Discounted professional check printing for payroll and accounts payable. Client banking authorization required for all check designs.

Immigration Document Services

We assist with the preparation and organization of immigration forms based on client-provided information. Not a law firm. No legal advice or legal representation provided.

Notarizations & Attestations

Notarizations & Attestations offers comprehensive and reliable notary services, ensuring that your important documents are authenticated and legally binding.

Translation Service

Our professional translation services provide accurate and reliable translations for all your communication needs.

Our local tax services are designed to help clients stay compliant, organized, and confident throughout the year. Whether you need individual or business tax preparation, monthly bookkeeping, payroll processing, or sales tax filing, our team delivers accurate and dependable support.American Elite Tax works closely with self-employed individuals, LLCs, and growing businesses to ensure timely filings, proper payroll reporting, and clear financial records.

Our payroll services help business owners manage employee payments, tax withholdings, and required filings efficiently and correctly.We focus on transparency, responsive communication, and practical solutions that reduce stress and support long-term success. By offering personalized service and affordable pricing, we help clients meet their financial and compliance obligations with confidence.If you are searching for reliable tax preparation, bookkeeping, and payroll services in Oak Creek or Milwaukee, American Elite Tax is ready to assist with professional guidance and local expertise.

Contact

- 6508 South 27th Street Ste. 5, Oak Creek, WI, USA

- +1-414-335-4555

- +1-414-301-4581

- info@nas-tax.com

- Mon-Fri 08:30AM - 04:30PM Sat-Sun Closed

Book Now

Book Now

- Category: Schedule Appointment

- Service Length: 30 Minutes

- Address: 6508 South 27th Street suite 5, Oak Creek, WI, USA (Map)

- Price:Free

News & Offers

9 STEPS TO STARTING A BUSINESS

A simple step-by-step guide to starting a business, including choosing a name, LLC setup, EIN registration, business bank account, bookkeeping, and required licenses.

How to Prepare for Tax Season: What You Need to Have Ready Before Filing

A simple guide on how to prepare for tax season, including documents, IRS form numbers, and what individuals and businesses need before filing.

Switch & Save: Get Your First 3 Months Free

Switch and save with American Elite Tax. New clients receive the first 3 months free for bookkeeping, payroll, or sales tax filing. Limited-time offer ends January 31, 2026. Terms apply.

Why Every Business Needs an Operating Agreement

Learn why every multi-member LLC or partnership needs an Operating Agreement. It protects owners, clarifies responsibilities, prevents disputes, and ensures smooth business management.